THE WILD WEST IS STILL WILD

Crypto isn’t just about memes and moonshots—it’s also a breeding ground for scammers, grifters, and professional rug-pullers. If you’re not careful, your wallet could go from degen to zero faster than a Gas Fee Monday on Ethereum. Let’s break down the most common scams in the game—with real examples—so you don’t end up the main character in a cautionary Twitter thread.

1. RUG PULLS

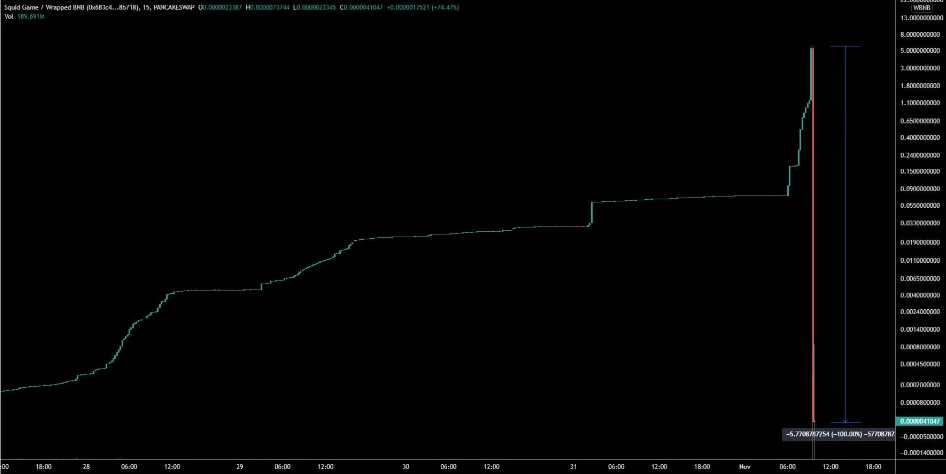

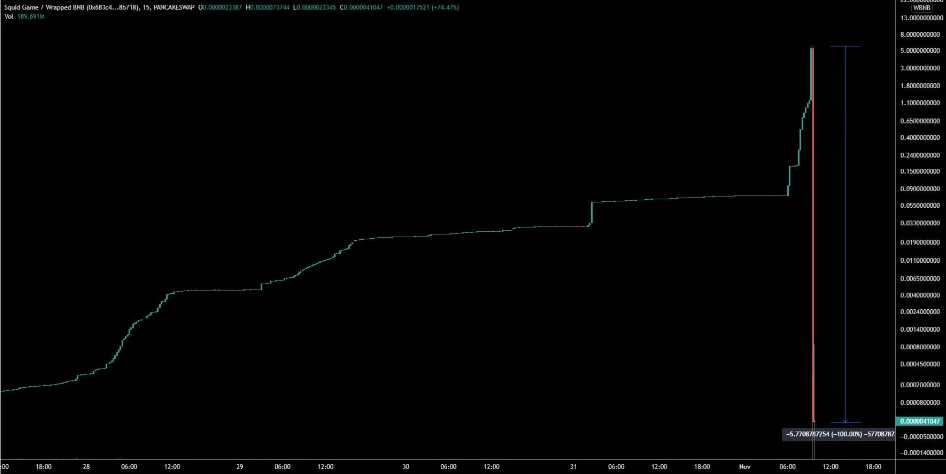

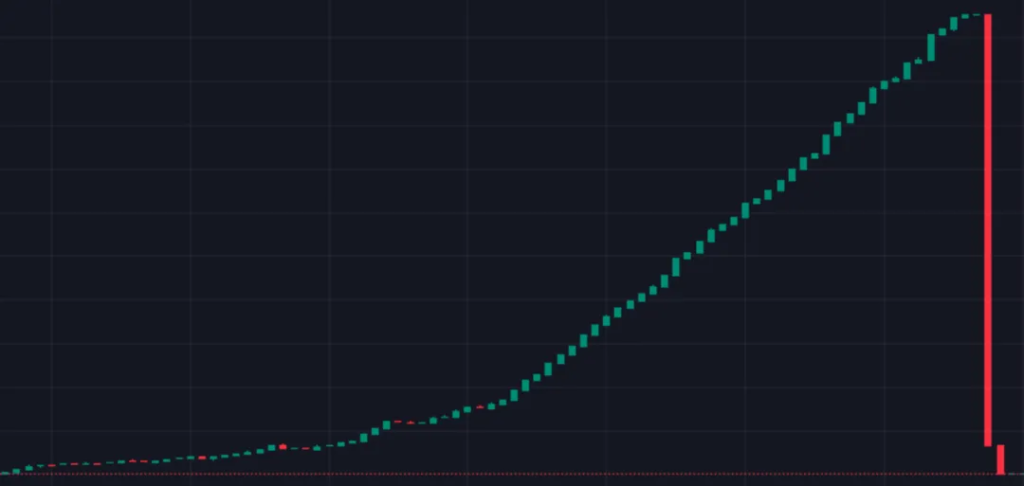

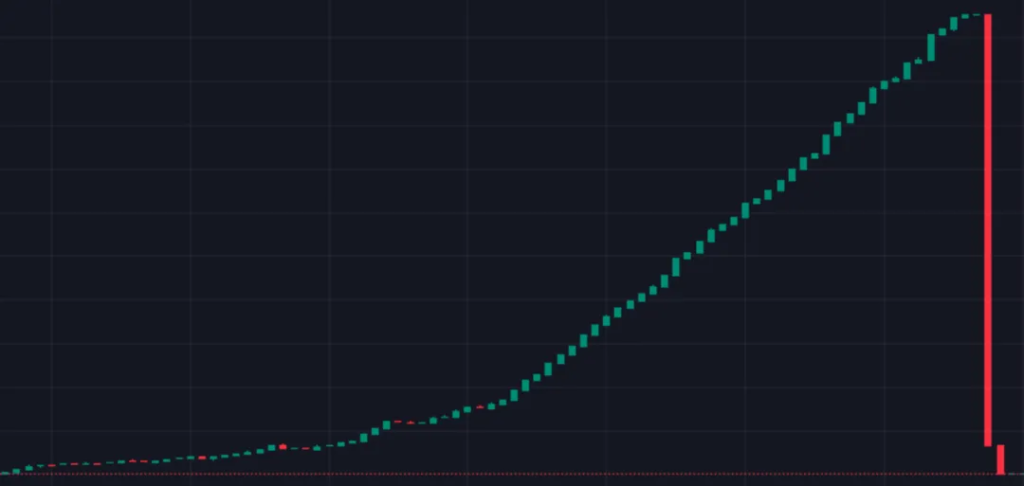

What it is: A dev team hypes a new token, gets everyone to buy in, then pulls all the liquidity and disappears. Boom—rugged.

Example: SQUID Token (yes, based on the Netflix show) pumped hard in 2021… then collapsed from $2,800 to $0 in minutes. Devs made off with millions while buyers got a lesson in “do your own research.”

How to avoid it: Check if the liquidity is locked. If the devs can yank it, you’re playing rug roulette.

2. HONEYPOTS

What it is: A token that you can buy, but can’t sell. You think you’re early, but you’re actually trapped.

Example: Countless coins on Pump.fun clones or shady Telegram shills turn out to be honeypots. You buy. Price goes up. You try to sell. Nothing happens. Someone else drains it while you cry into your seed phrase.

How to avoid it: Use tools like Honeypot.is or TokenSniffer before you buy anything. Always test with a small amount first.

3. FAKE AIRDROPS

What it is: You get a DM or random post claiming you’ve “won” an airdrop. All you have to do is connect your wallet or pay a small “gas fee.” Classic.

Example: During the Arbitrum airdrop hype, fake sites were everywhere. Some users clicked fake Arbitrum links, signed malicious transactions, and lost entire wallets.

How to avoid it: Never connect your wallet to a site you didn’t find yourself. Airdrops never ask you to pay to claim.

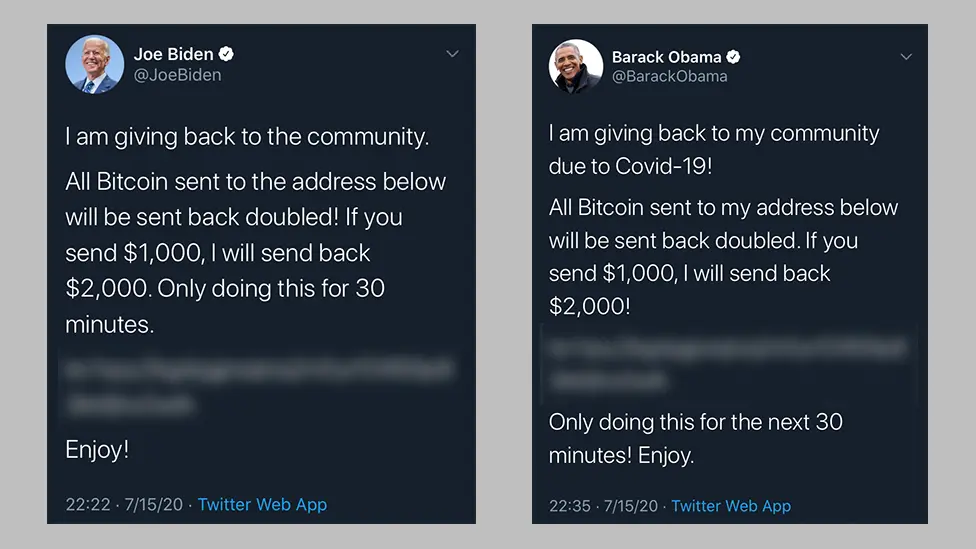

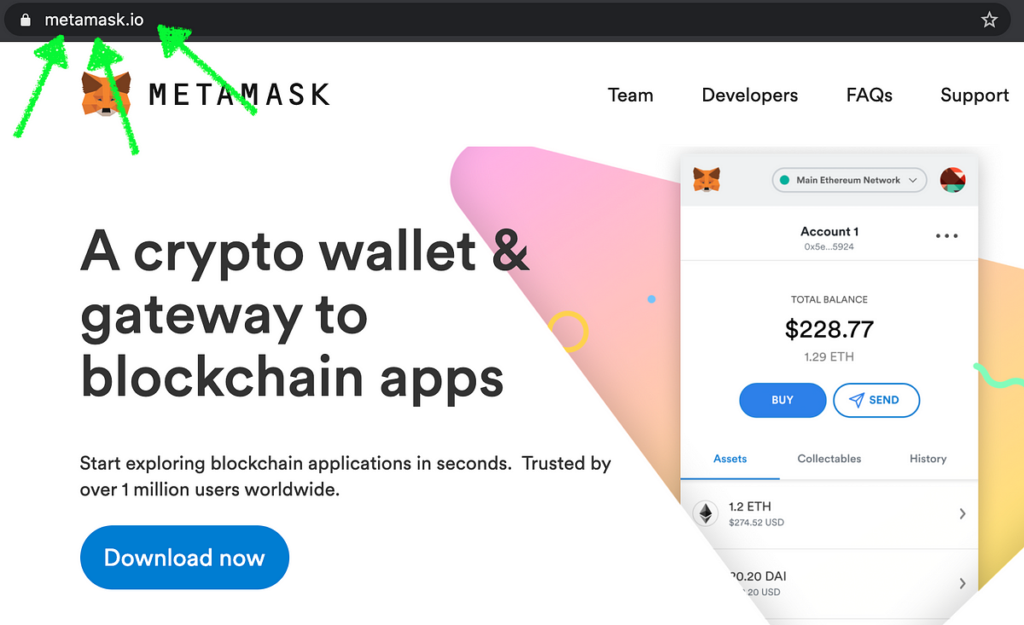

4. IMPERSONATOR SCAMS

What it is: Scammers create copy accounts of well-known influencers or devs, then promote fake projects or phishing links.

Example: There are hundreds of fake Vitalik Buterin, CZ, and Alex Becker accounts on Twitter at any given time. One tweet with a “special promo” and people line up to get scammed.

How to avoid it: Always double-check usernames and handles. Real influencers rarely slide into your DMs promising you free crypto.

5. PUMP AND DUMP DISCORD GROUPS

What it is: A group promises secret alpha on low-cap gems. They pump a token, then dump on their own members. You’re the exit liquidity.

Example: Tons of “alpha” Discords coordinate buys on tokens they already hold. The price spikes, you FOMO in, and they sell into you. You’re left with a bag no one wants.

How to avoid it: Don’t trust calls from people you just met in a Telegram group. Real projects don’t need pump groups to survive.

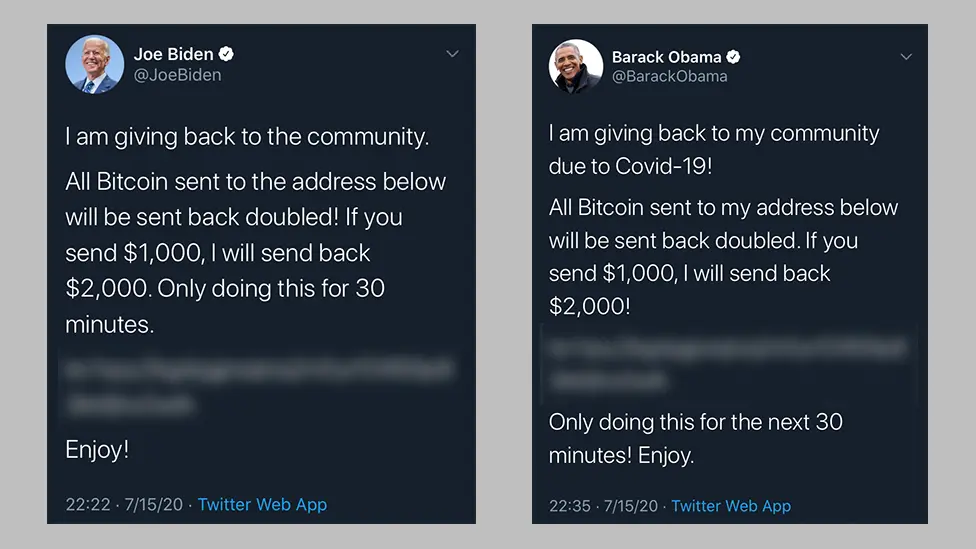

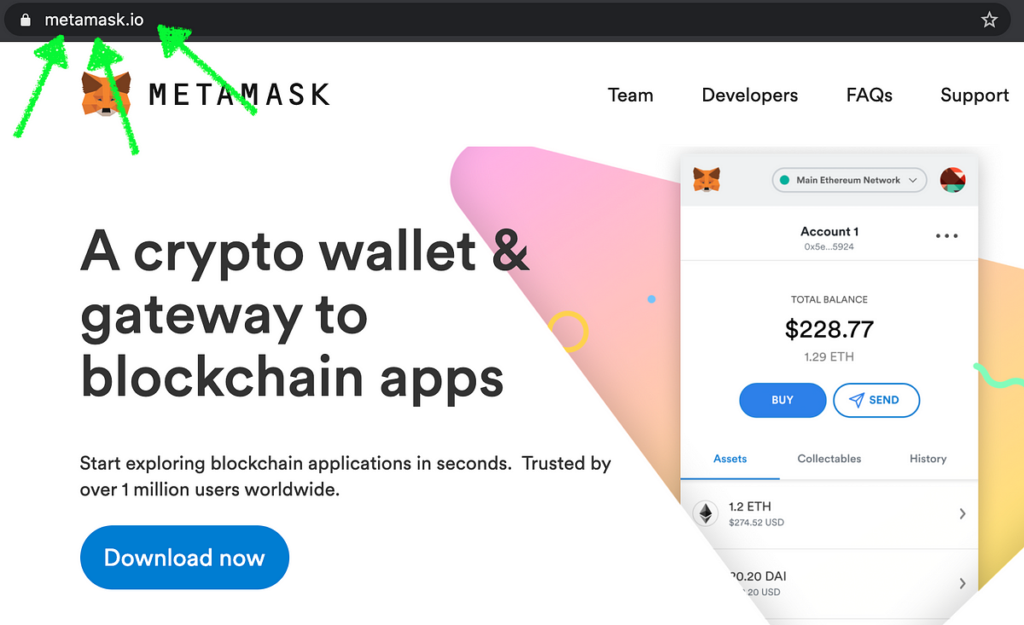

6. FAKE WALLETS AND BROWSER EXTENSIONS

What it is: Malicious versions of MetaMask or Phantom that look real but steal your seed phrase.

Example: Fake MetaMask extensions hit Chrome and Firefox users in 2022. One bad install and poof—everything gone.

How to avoid it: Always download wallets from official sites. Bookmark them. Don’t Google “Phantom wallet download”—that’s how they get you.

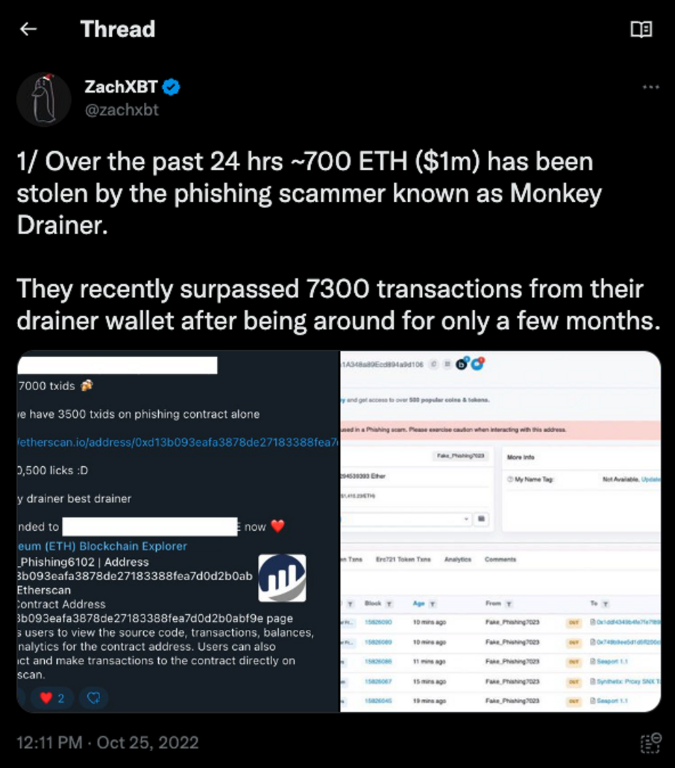

7. TOKEN APPROVAL DRAINERS

What it is: You approve a token to interact with a sketchy dApp, and it gets access to all your tokens.

Example: A fake staking site lured users to approve token access. Once approved, the contract drained their wallets on the backend without any future interaction.

How to avoid it: Use Revoke.cash regularly to clean up token approvals. Never approve “unlimited access” unless you know exactly what you’re doing.

The Bottom Line

Crypto is full of opportunities—but it’s also full of traps. If you’re gonna play the game, play smart. Assume every link is a scam until proven innocent, don’t trust random influencers, and never, ever connect your main wallet to a site you found through a Twitter reply.

Stay sharp, trenchers.